Vietnam’s digital finance industry is undergoing significant change with the emergence of new players, the decline of existing players and the rise of traditional banks, according to a new report from Decision Lab. show.

Q4 2022, Moca by Grab Ranking A survey of over 1,500 consumers revealed that Moca is the sixth most used digital financial platform in Vietnam, with a penetration rate of 8%. However, by Q4 2023, Moca will drop from the top rankings, to be replaced by traditional bank mobile apps.

According to the data, these incumbents made strong advances, achieving a combined penetration rate of 23%, securing them the fifth spot.

This shift in Vietnam’s digital finance scene not only shows that banks are responding to the challenge posed by fintech companies by strengthening their digital capabilities, but also that there is a major move towards mobile banking among customers.

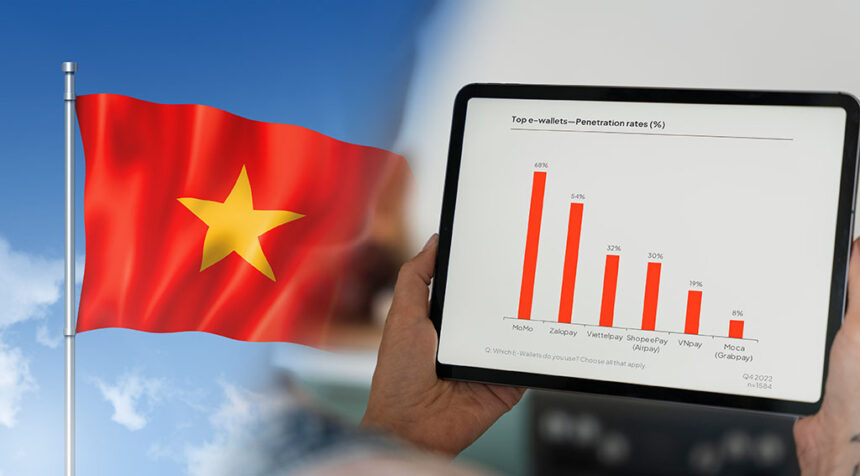

Top e-wallets by penetration in Vietnam (%), Source: The Connected Consumer Q4 2022, Decision Labs, February 2023

This reflects the popularity of digital financial platforms in Vietnam, which has led to increased competition among service providers. Last month, Grab announced it would stop operating its Moca e-wallet service from July 1, 2024. The company stated The company said it had conducted a careful evaluation as part of its restructuring strategy and had “Sustainable Growth.”

Increasing competition in payments is also spurring innovation in the banking sector. State Bank of Vietnam (SBV) Quote At least 96 percent of Vietnamese banks have drawn up plans for digital transformation, and 92 percent are developing internet and mobile application services.

For example, the Vietnam Bank for Agriculture and Rural Development (Agribank) has introduced Agribank Digital, a set of digital tools and devices designed to improve financial access in rural areas in 2022. Each Agribank Digital machine: Equipped It has functions as a banking counter, including identity verification, biometric registration, account opening, card issuance, e-banking services, loan applications and financial transactions.

Meanwhile, Military Bank (MB) has been implementing its digital transformation strategy since 2018 through a strategic partnership with IBM. The strategy revolves around a “self-service” and “all-in-one app” model, aiming to create convenience and flexibility for individuals and businesses. Vu Thanh Trung, Director of Digital Banking at MB, said: Said The Vietnam News Agency (VNA) reported in December 2023 that the bank was spending an average of about US$50 million each year on digital transformation.

SBV Quote Vietnam’s banking industry has invested more than VND15 trillion ($617.6 million) in digital transformation by the end of 2022.

MoMo, ZaloPay maintain top spot despite declining penetration

MoMo and ZaloPay remained the top digital financial platforms in Vietnam in Q4 2023, with penetration rates of 62% and 45%, respectively, revealed the Connected Consumer Survey results for Q4 2023. However, these figures represent a decrease of 6 and 9 percentage points from Q4 2022.

Overall, usage of major digital financial platforms has decreased between the two periods, with Viettel (-5 points), ShopeePay (-4 points) and VNPay (-2 points) also seeing declines in penetration compared to Q4 2022.

Vietnam Top Digital Financial Platforms Penetration Rate (%), Source: The Connected Consumer Q4 2023, Decision Labs, 2024

this is, entry Apple Pay is scheduled to be introduced in the Vietnamese market in August 2023. Apple Pay is a mobile payment service that allows users to make payments in person, in iOS apps and on the web. It digitizes and replaces credit and debit card chip-and-PIN transactions at contactless-enabled POS terminals.

At the time of releaseMajor banks in Vietnam, including ACB, MB, Sacombank, Techcombank, Vietcombank and VPBank, support Apple Pay and allow customers to apply to add virtual debit cards to their digital wallets. Retailers such as Adidas, Lotte Mart, McDonald’s, Starbucks and Shopee have also adopted Apple Pay.

Last Available estimate The biggest problem for Apple Pay users around the world is that over 500 million people have started using the service on their iPhones. Statista Consumer Insights list The country with the highest Apple Pay penetration is the UK, followed by Canada, the US and Australia.

Apple Pay usage for online payments or at the point of sale around the world as of April 2024, Source: Statista, April 2024

In Vietnam, Apple Pay is set to achieve a 7% penetration rate by the fourth quarter of 2023. Apple Pay competes with local and regional mobile payment and digital wallet services as well as platforms offered by other tech giants such as Samsung Pay. Release Google Pay (formerly Google Wallet), introduced in Vietnam in 2017, Arrived November 2022.

Currently, there are 51 non-banking institutions. license The SBV will provide intermediary settlement services in the market.

The rise of digital payments in Vietnam’s digital finance scene

The SBV said digital payments have grown 40 percent over the past four years, driven by the fastest rate of digital transformation in the world. Around 90 percent of banking transactions are now conducted through digital channels, and 74.6 percent of adults have a bank account.

Non-cash payments have also increased significantly, with 82 financial institutions offering internet-based payment services and 51 financial institutions offering mobile payment services as of the end of 2022. according to To VNA.

According to a survey by Decision Lab, bill paying, remittance and QR code payments are the most used features on digital financial platforms in Vietnam, with expense tracking and savings also popular.

Most Used Features in Digital Financial Platforms, Source: The Connected Consumer Q4 2023, Decision Labs, 2024

As of March 2023, approximately 3.71 million mobile money accounts have been opened, with over 70% of them in rural and disadvantaged areas.

Vietnam Release The government released the National Financial Inclusion Strategy in 2020, which aims to increase the proportion of adults with bank accounts to 80% by 2025. The strategy aims to ensure that individuals and businesses, especially low-income earners, vulnerable groups, and MSMEs, have convenient and affordable access to basic financial products and services such as payments, remittances, savings, credit, and insurance.

The plan aims to establish financial service offices in at least 50 percent of the country’s municipalities, have 25-30 percent of adults have savings accounts with credit institutions, increase the number of non-cash transactions by 20-25 percent annually, and increase insurance premium income to about 3.5 percent of gross domestic product by 2025.

Featured Image Credit: Free Pick