by calculated risk May 8, 2024 07:00:00 AM

From MBA: Mortgage applications increase in latest MBA weekly survey

According to data from the Mortgage Bankers Association’s (MBA) Mortgage Applications Weekly Survey for the week ending May 3, 2024, the number of mortgage applications increased 2.6% from the previous week.

The market composite index, which measures the number of home loan applications, rose 2.6% from a week ago on a seasonally adjusted basis. On an unadjusted basis, the index rose 3% compared to the previous week. The refinance index rose 5% from the previous week and fell 6% from the same week last year. The seasonally adjusted purchasing index increased by 2% compared to a week ago. The unadjusted purchasing index increased by 2% compared to the previous week; 17% decrease compared to the same week one year ago.

“Last week, with the job market slowing, wage growth at its slowest pace since 2021, and the Federal Reserve announcing plans to ease quantitative tightening in June, further rate hikes are unlikely. Treasury rates and mortgage rates fell as the Bank maintained its view that it was unlikely. The traditional 30-year rate fell 11 basis points and the FHA rate fell 17 basis points to 6.92%, falling below 7% for the first time in three weeks,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. said. “Mortgage applications increased for the first time in three weeks, and refinances also increased by 5%. Despite this increase, which included a 29% jump in VA refinances, the number of refinance applications still remains below last year’s already low levels by about 6%. percent below.”

Kan added: “Purchase activity increased 2%, driven by a 5% increase in FHA applications. First-time homebuyers account for approximately half of purchase loans, and government financing programs are an important source of financing for these homebuyers. The increase in FHA activity indicates that this market segment is active.

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased from 7.29% to 7.18%, the points remained unchanged at 0.65 points (including origination fees), and the loan-to-value ratio decreased from 7.29% to 7.18%. It became 80%. (LTV) Loan.

Emphasis added

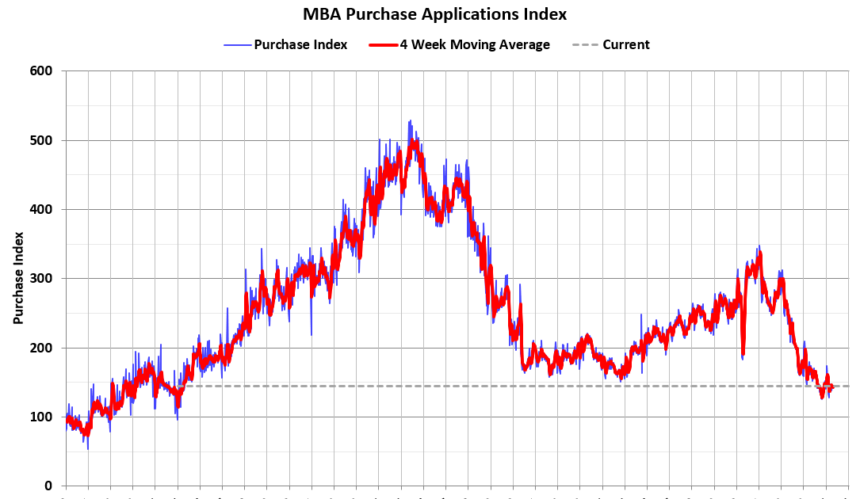

The first graph shows the MBA Mortgage Purchase Index.

Purchasing activity is down 17% year-over-year on an unadjusted basis, according to MBA.

Red is the 4-week average (blue is weekly).

Purchase application activity is up slightly from its lowest level in late October 2023 and remains below the lowest level during the housing crisis.

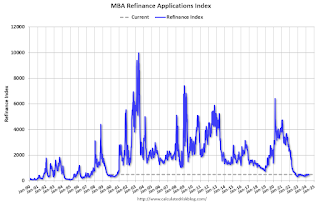

Due to rising mortgage rates, the refinance index will decline sharply in 2022 and have remained roughly flat since then.